mississippi income tax calculator

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Mississippi local counties cities and special taxation districts. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

Mississippi Income Tax Calculator Smartasset

Box 23050 Jackson MS 39225-3050.

. 1040 Tax Calculator Enter your filing status income deductions and credits and we will estimate your total taxes. Mississippi Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Ad Free Tax Calculator.

5 on all taxable income over 10000. Income Tax Calculator 2021 Mississippi 72500 Mississippi Income Tax Calculator 2021 If you make 72500 a year living in the region of Mississippi USA you. See What Credits and Deductions Apply to You.

The Mississippi income tax calculator is designed to provide a salary example with salary deductions made in. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators. If you would like to help us out donate a little Ether cryptocurrency.

Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators. Mississippi Paycheck Calculator - SmartAsset SmartAssets Mississippi paycheck calculator shows your hourly and salary income after federal state and local taxes. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

Calculate your Mississippi net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Mississippi paycheck calculator. Your average tax rate is. Mississippi Income Tax Calculator 2021 If you make 70000 a year living in the region of Mississippi USA you will be taxed 11472.

4 on the next 5000 of taxable income. Estimate Your Tax Refund. State Date State Mississippi.

The Mississippi tax tables here contain the various elements that are used in the Mississippi Tax Calculators Mississippi Salary Calculators and Mississippi Tax Guides on iCalculator which are designed for quick comparison of salaries and the calculation of withholdings for typical employees and employers. The MS Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for single joint and head of household filing in MSS. Mississippi has a graduated tax rate.

After entering it into the calculator it will perform the following calculations. 0 on the first 4000 of taxable income. After a few seconds you will be provided with a full breakdown of the tax you are paying.

This tool was created by 1984 network. 3 on the next 1000 of taxable income. Thankfully our Mississippi state tax calculator is a simple accurate way to calculate your tax liabilities in the Magnolia state.

Be sure to accurately report all income you earned along with the relevant dates and locations in order to prorate your exemptions and deductions. The process is simple. To use our Mississippi Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Based on your projected tax withholding for the year we can also estimate your tax refund or amount. All other income tax returns P. Discover Helpful Information And Resources On Taxes From AARP.

How many income tax brackets are there in Mississippi. File Form 80-205 the Mississippi Non-Resident or Part-Year Resident Individual Income Tax Return 2019. Figure out your filing status work out your adjusted gross income Total annual income Adjustments Adjusted gross income.

Mississippi Income Tax Calculator - SmartAsset Find out how much youll pay in Mississippi state income taxes given your annual income. As you can see your income in Mississippi is taxed at different rates within the given tax brackets. The state income tax rate in Mississippi is progressive and ranges from 0 to 5 while federal income tax rates range from 10 to 37 depending on your income.

Tax Rate Income Range Taxes Due 0 0 - 4000 0 within Bracket 3 4001 - 5000 3 within Bracket 4 5001 - 10000 4 within Bracket 5 10001 5 over 10000. Mississippi residents have to pay a sales tax on goods and services. Mississippi Income Tax Calculator How To Use This Calculator You can use our free Mississippi income tax calculator to get a good estimate of what your tax liability will be come April.

Any income over 10000 would be taxes at the highest rate of 5. The Mississippi tax calculator is updated for the 202223 tax year. Create Your Account Today to Get Started.

Calculate your net income after taxes in Mississippi. Customize using your filing status deductions exemptions and more. Enter Your Tax Information.

This Mississippi hourly paycheck calculator is perfect for those who are paid on an hourly basis. Change state Check Date General Gross Pay. Information on Available Tax Credits.

- FICA Social Security and Medicare. There is no tax schedule for Mississippi income taxes. Switch to Mississippi hourly calculator.

Enter your info to see your take home pay. The graduated income tax rate is. Filing 5500000 of earnings will result in 420750 being taxed for FICA purposes.

This income tax calculator can help estimate your average income tax rate and your salary after tax. All you have to do is enter each employees wage and W-4 information and the calculator will process their gross pay deductions and net pay for both Mississippi and Federal taxes. You will only be taxed on income earned in Mississippi.

Mississippi Code at Lexis Publishing Income Tax Laws Title 27 Chapter 7 Mississippi Code Annotated 27-7-1 Income Tax Regulations Title 35 Part III Mississippi Administrative Code. Mississippi sales tax rates. Mississippi uses a graduated income tax bracket system which means tax rates are structured according to income.

The higher income Mississippi taxpayers bring in. Filing 5500000 of earnings will result in 508750 of that amount being taxed as federal tax. - Mississippi State Tax.

These rates are the same for individuals and businesses. Calculating your Mississippi state income tax is similar to the steps we listed on our Federal paycheck calculator. On the next page you will be able to add more details like itemized deductions tax.

The Mississippi Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Mississippi State Income Tax Rates and Thresholds in 2022.

![]()

Mississippi Income Tax Calculator 2022 With Tax Brackets And Info Investomatica

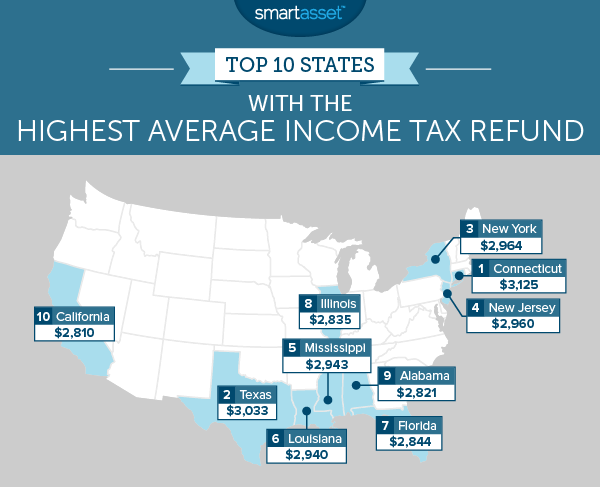

The Average Tax Refund In Every State Smartasset

States Continue To Take Steps Toward Income Tax Elimination

With 2 Months Left In Fiscal Year Mississippi State Revenues On Pace To Meet Or Exceed Revised 6 875 Billion Estimate Mississippi Politics And News Y All Politics

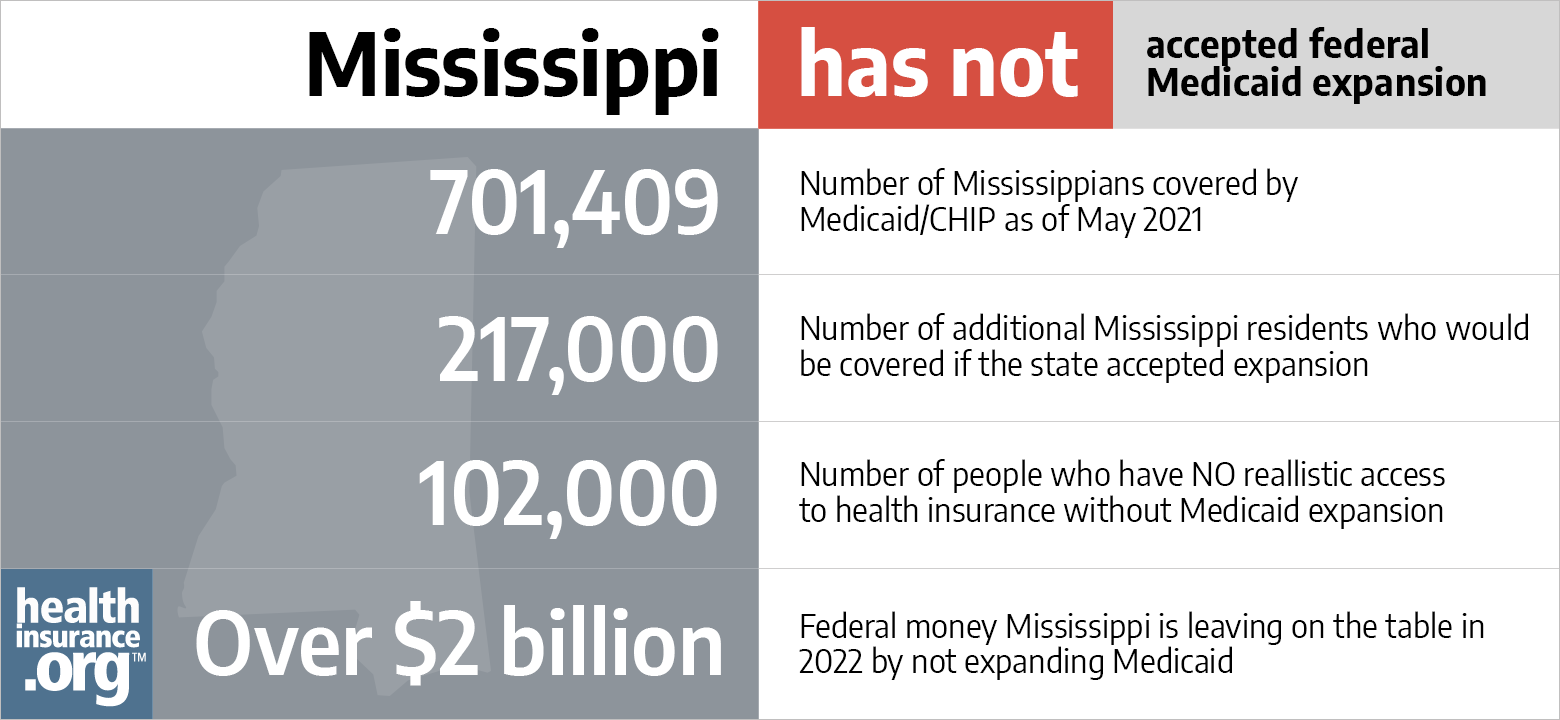

Aca Medicaid Expansion In Mississippi Updated 2022 Guide Healthinsurance Org

Tax Rates Exemptions Deductions Dor

1040 Tax Calculator United Mississippi Bank

Where S My Refund Mississippi H R Block

Free Mississippi Payroll Calculator 2022 Ms Tax Rates Onpay

Mississippi Sales Tax Guide And Calculator 2022 Taxjar

Mississippi Income Tax Calculator 2022 With Tax Brackets And Info Investomatica

Mississippi Tax Rate H R Block

Mississippi Tax Rate H R Block

Mississippi Retirement Taxes And Economic Factors To Consider

Mississippi Paycheck Calculator Updated For 2022

Mississippi Income Tax Calculator Smartasset

Tax Rates Exemptions Deductions Dor

Mississippi State Taxes 2021 Income And Sales Tax Rates Bankrate